-

Designating a Beneficiary for your Investment Account

When it comes to your investments, planning ahead is vital. Here are the basics of why beneficiaries are critical for building and maintaining financial security for you and your family.

-

Two Words That Can Boost Your Credit Score

Looking to purchase a home or maybe a new car? Unless you intend to pay for these big-ticket items in cash, you’re likely going to need a good credit score.

-

Three Reasons to Consider Debt Consolidation

Investing is one of the best paths to a secure financial future. Before you start, you may want to consider paying off high-interest rate debt (i.e.: credit cards).

-

The Price of Procrastination

Read our story about twin sisters Millie and Hope. Millie invested $500/month and retired with more than Hope who invested $1500/month. How did she do it?

-

The Million Dollar Mercedes

That new car might be more expensive than you think.

-

Making the Most of One Thousand Paychecks

If you enter the workforce at 25 years old, get paid twice a month, and strive to retire at 65 years old, you can expect to receive roughly 1,000 paychecks over your career.

-

5 Tips to Help You Save More Money

Your savings are designed to help you get through tough times, cover unexpected mishaps, and eventually invest.

-

This 23-Year-Old Lives in NYC on $50K a Year

Living in one of the busiest and most expensive cities in the U.S. can become expensive in a hurry.

-

Why a Down Market Is No Cause for Panic

Notice the market moves lately? Are you feeling like the bottom is falling out?

-

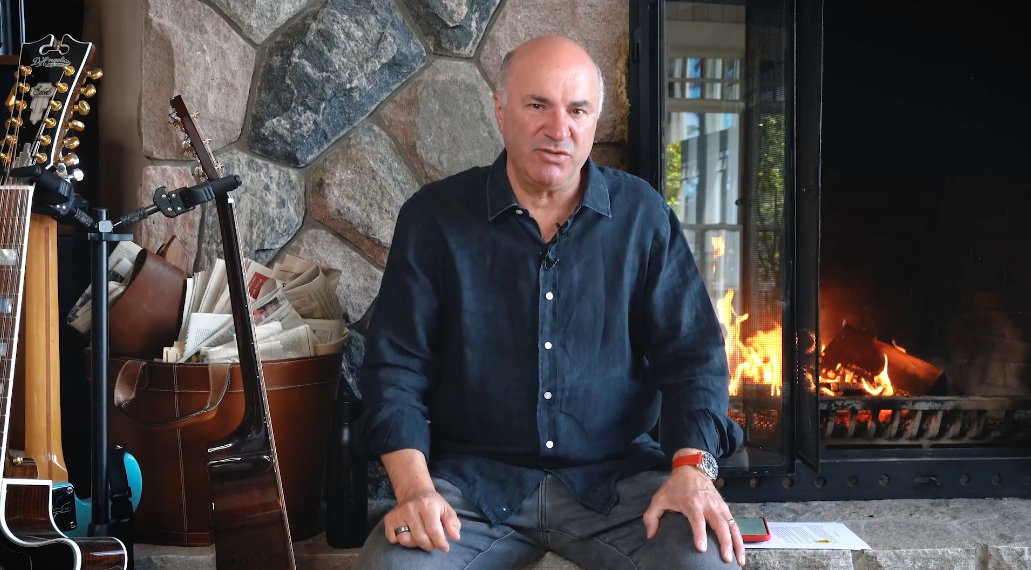

What Makes Beanstox Different?

What makes Beanstox different is how we invest for our clients.