1. Discipline over guessing and headline chasing

Once again 2025 showed me why automated diversified investing is smart. Not investing by chasing headlines. Some investments were up 20% or more in 2025, but others were down. However, historically some of the best days for the market follow the worst ones, which helps explain why steady long-term investing works better for so many people to build wealth long term. That’s also why automation and consistency matter more than opinions and guesses.

- Diversification!

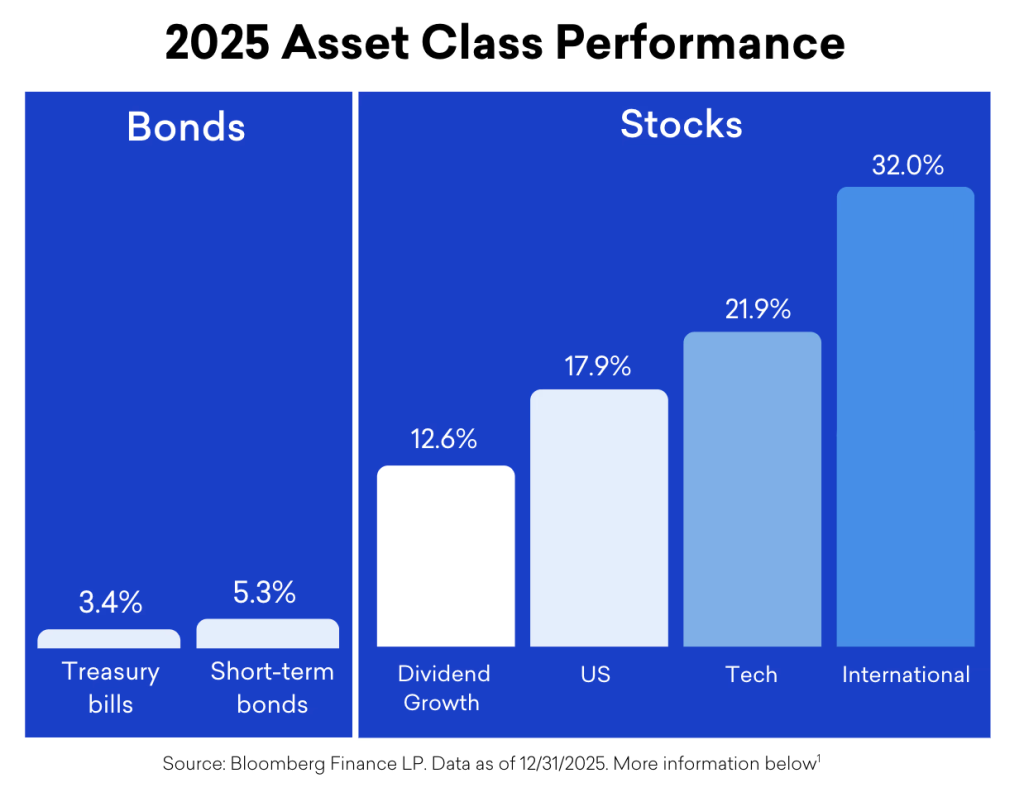

In 2025, different assets took turns leading, while some recent winners dropped. U.S. stocks were strong. Gold had an exceptional year. Bitcoin was volatile, temporarily dropping about 30%, ending the year down about 6%.

Diversification is my “bedrock”. No asset class wins every year which is why diversified investing is very important. You can automate investments in diversified portfolios using apps. Beanstox Wealth Builder portfolios take the emotion out of investing and make diversification easy.

- Use tax-advantaged accounts and you could reduce taxes

IRAs are very useful and can allow tax advantaged investment growth over time. Using a Traditional IRA can reduce annual taxes. Contributions made by April 15, 2026, could reduce your taxes for 2025 and boost your tax refund. A Roth IRA can reduce long-term taxes on your investment gains. Some people use both types of IRA accounts. Beanstox makes it easy to

automate your IRA contributions and keep you disciplined year after year.

Simple choices for 2026. You can start small and grow over time!

After setting up your diversified investment “bedrock”, Beanstox offers several options and uses ETFs to make investing simple with self-directed portfolios:

- Power Savings (T-bills): Earn more income than “money in the bank”

- Stocks 500: A way to own 500 of the largest U.S. companies, simple and efficient

- Gold (ETF): Many investors have some gold investment for diversification

- Bitcoin: Digital assets are newer and often have large price swings and are riskier, but if you’re interested, ETFs make it easier to invest

These can be “add-on” investments, not replacements for diversification.

Game Plan for 2026

- Start with diversified investing: You can automate with Wealth Builder

- Get tax advantages using IRAs – Start funding them early

- Consider simple self-directed add-on investments and keep it Simple. Disciplined. Repeatable.

Footnote: